Last month I wrote a post about the tax reform bill’s announcement. This month, we’ve gotten a much closer look at just what is in it (and what is not in it). Unfortunately, neither the house proposal or the senate proposal currently includes an extension of the 179(d) tax deduction. Both address some Section 179 reforms, but do not extend, make permanent or change deductions allowed under 179(d) in any way.

Not all hope is lost, of course. Rarely does a bill become law without changes between it’s introduction and final approval. Even if this bill becomes law, there is always a chance that some other bill comes along and reinvigorates Section 179(d). We will continue to pay attention to any new laws that affect 179(d) and post any updates here on our website.

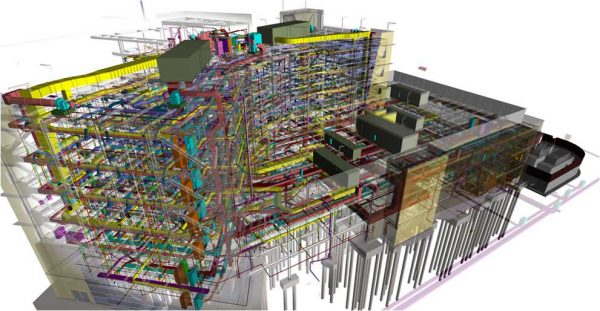

In the meantime, Forward Engineers can still help you make energy efficient decisions that will save you money by reducing energy in your buildings. We provide commercial MEP engineering in addition to our energy consulting including energy audits, utility incentive programs and much more. If you are interested in any of these services or have a project coming up, please don’t hesitate to contact us.