Summer is almost here and it is already very hot and humid in Arkansas. Despite the heat, we have been busy at Forward Engineers and have a few exciting announcements:

New Website: I am happy to officially unveil our new website. It’s been available for a few weeks now, but I wanted to iron out any kinks before advertising it. Please visit our site to learn more about us, our services and to see some of our past projects. We periodically post updates and interesting articles to our news page so be sure to check that out. If you prefer, our posts are also available on our Facebook and LinkedIn pages.

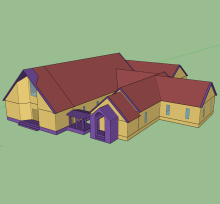

Design Services: We love energy consulting and we feel that the next logical step is to not only make recommendations but to complete the designs as well. Therefore, we are seeking to grow the design side of our business. If you have MEP design needs, please contact us and we’ll put together a quality design at a great price while keeping construction and future energy costs low.

Energy Consulting: Our specialty continues to be making energy efficiency recommendations and completing incentive certification/applications. If you have recently completed a facility or a renovation and are curious about what incentives are available, be sure to contact us and we’ll review your project for free.